Labor might not be the first thing that comes to mind when you think about crop insurance, but more and more growers are realizing that uncertainty in the workforce is becoming just as unpredictable as the weather.

Over the past few years, labor has become harder to find — and harder to count on. Shifts in visa programs, rising costs, and fewer available workers are leading some growers to plant less or scramble to get crops harvested in time. When timing is everything, labor uncertainty can mean lost yields and income.

🧑🌾 So how does crop insurance fit in?

While it’s true that crop insurance doesn’t cover labor shortages directly, it does protect you when that shortage leads to actual crop loss or lost production revenue. For example:

- If you can’t harvest in time and lose yield — that’s covered.

- If your expected revenue drops due to missed windows or lower output — covered under revenue protection.

- If a planting delay causes you to miss key dates — that may be covered too, depending on the situation.

📈 Trends show the pressure is rising

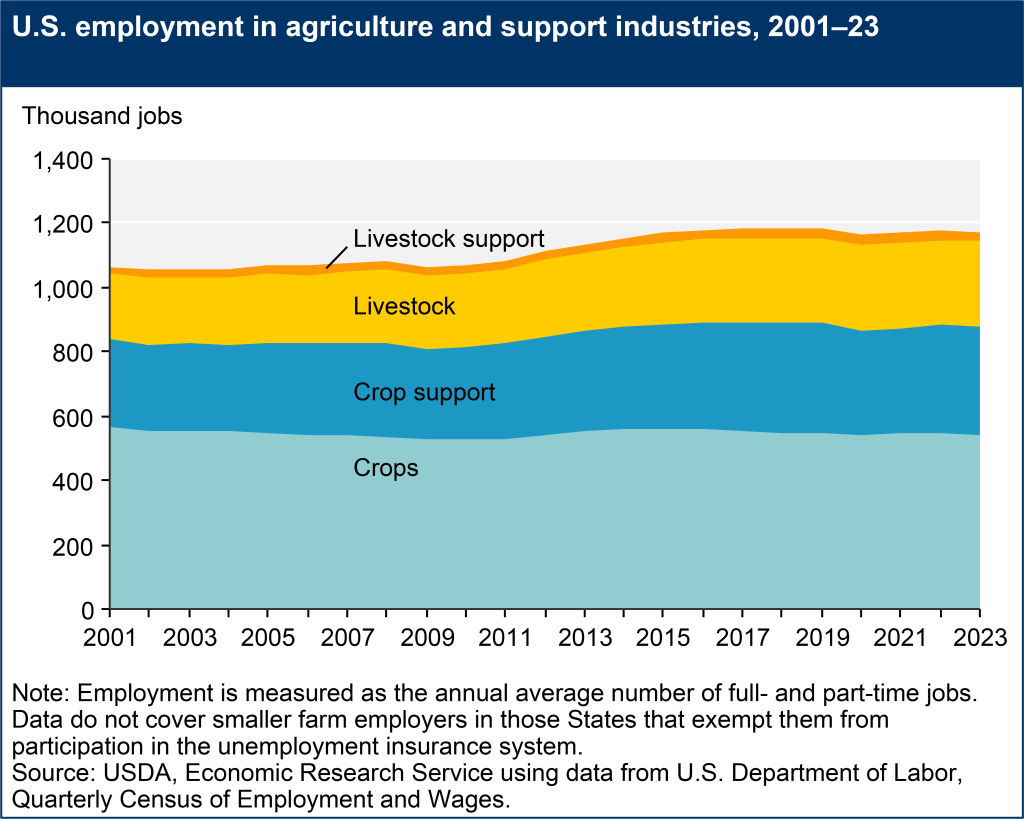

Here’s a quick look at the trend in farm labor reliance over time:

Source: USDA Economic Research Service

With more growers depending on temporary or seasonal labor — and fewer backup options — crop insurance becomes one of the only tools left to protect your bottom line when things don’t go as planned.

💡 Plan ahead, protect your season

If labor uncertainty is part of your planning conversations this year, it might be time to take a closer look at your crop insurance strategy. Make sure:

- Your coverage reflects your actual risk, including delayed planting or harvest

- You’re familiar with claim triggers tied to timing and revenue

- You’re keeping up with reporting deadlines so nothing slips through the cracks

Want help figuring out how your policy can support you this season?

Let’s talk before the next deadline: cimxag.com/contact-us