General Liability Insurance

Who Needs General Liability Insurance?

If news headlines and television commercials about businesses having to pay huge sums in customer injury lawsuits have you wondering how you’d get through that situation, general liability insurance is the answer.

Even if safety is considered first in your daily business preparations, accidents can happen. Therefore, most small businesses need this type of policy, specifically those that rent or own offices or commercial space. In fact, many client contracts will require a business to have general liability insurance.

If you work directly with customers and clients, you need a general liability policy to protect your finances in the event of a lawsuit. It’s one of the first type of insurance coverage most new businesses obtain.

What Does It Cover?

Our general liability insurance policies provide protection from the types of accidents that can happen in nearly every business. Here are some examples of the things we cover.

Physical Harm that Results with Accidents

If your business is sued over an injury that occurs to someone who is not an employee, it can provide coverage for the injured person’s medical expenses, loss of income and pain and suffering if your business is found to be responsible.

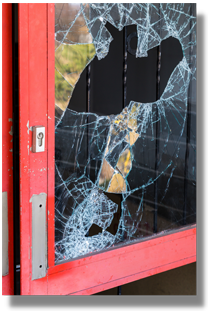

Property Damage

General liability insurance covers damage that your business causes to another person’s property, whether it is minor or major, up to the policy’s limit. of coverage.

Libel, Slander And Copyright Infringement

If you are accused of copyright or advertising infringement, defamation of character or invasion of someone else’s privacy, your legal expenses will likely be covered.